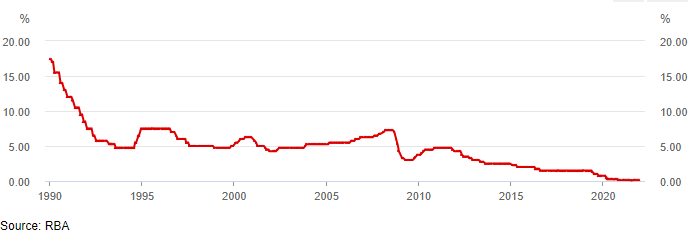

Cash Rate On Hold at 0.10%

[ad_1]

Assertion by Philip Lowe, Governor: Financial Coverage Choice

At its conference now, the Board determined to keep the income rate target at 10 basis factors and the desire fee on Trade Settlement balances at zero per cent.

Graph of the Funds Level Focus on

Bond Yields

Inflation has elevated sharply in numerous areas of the entire world. Ongoing supply-side complications, Russia’s invasion of Ukraine and potent demand as economies recover from the pandemic are all contributing to the upward pressure on price ranges. In reaction, bond yields have risen and expectations of potential coverage curiosity charges have enhanced.

Omicron Outbreak

The Australian economy continues to be resilient and paying out is choosing up adhering to the Omicron setback. Domestic and organization stability sheets are in typically excellent shape, an upswing in small business investment is underway and there is a big pipeline of construction perform to be concluded. Macroeconomic plan settings also stay supportive of growth and nationwide income is remaining boosted by larger commodity prices. At the identical time, rising prices are putting pressure on house budgets and the floods are producing hardship for several communities.

Labour Marketplace

The toughness of the Australian economic system is obvious in the labour marketplace, with the unemployment fee slipping more to 4 for every cent in February. Underemployment is also at its least expensive stage in several decades.

Task vacancies and work ads are at substantial ranges and stage to continuing powerful progress in work about the months forward. The RBA’s central forecast is for the unemployment rate to fall to underneath 4 for every cent this calendar year and to keep on being beneath 4 for each cent upcoming 12 months.

Wages expansion has picked up, but, at the combination amount, is only all around the comparatively very low costs prevailing in advance of the pandemic. There are, having said that, some locations the place more substantial wage increases are transpiring. Specified the tightness of the labour sector, a even more pick-up in combination wages development and broader actions of labour costs is in prospect.

This choose-up is nevertheless predicted to be only gradual, even though there is uncertainty about the conduct of labour costs at historically lower amounts of unemployment.

Inflation

Inflation has elevated in Australia, but it remains lessen than in quite a few other nations around the world in fundamental phrases, inflation is 2.6 per cent and in headline terms it is 3.5 per cent. Better costs for petrol and other commodities will end result in a further carry in inflation about coming quarters, with an up to date established of forecasts to be released in May well.

The major resources of uncertainty relate to the pace of resolution of the various provide-facet problems, developments in world electrical power markets and the evolution of overall labour expenses.

Housing Marketplaces

Monetary problems in Australia carry on to be really accommodative. Fascination fees remain at a really minimal stage, while mounted mortgage loan fees for new financial loans have risen lately.

The Australian dollar exchange charge has appreciated due to the increased commodity price ranges and, in TWI phrases, is about the amount of a 12 months back. Housing price ranges have risen strongly about the past yr, while some housing marketplaces have eased recently.

With desire fees at historically small amounts, it is significant that lending expectations are preserved and that borrowers have ample buffers.

The Determination

The Board’s insurance policies during the pandemic have supported progress towards the objectives of whole work and inflation reliable with the goal.

The Board has desired to see real proof that inflation is sustainably inside the 2 to 3 per cent goal vary ahead of it will increase fascination prices. Inflation has picked up and a further more raise is expected, but advancement in labour charges has been below costs that are probable to be constant with inflation currently being sustainably at target.

Over coming months, important extra evidence will be offered to the Board on both of those inflation and the evolution of labour costs.

The Board will evaluate this and other incoming info as its sets coverage to aid total work in Australia and inflation results constant with the concentrate on.

[ad_2]

Resource backlink