Generational Wealth Transfer | bubbleinfo.com

[ad_1]

Are you questioning if our regional housing market place could manage current pricing – or even go larger? It is probable, and if it takes place, a big reason will be little one boomers pitching in to support their kids obtain a property.

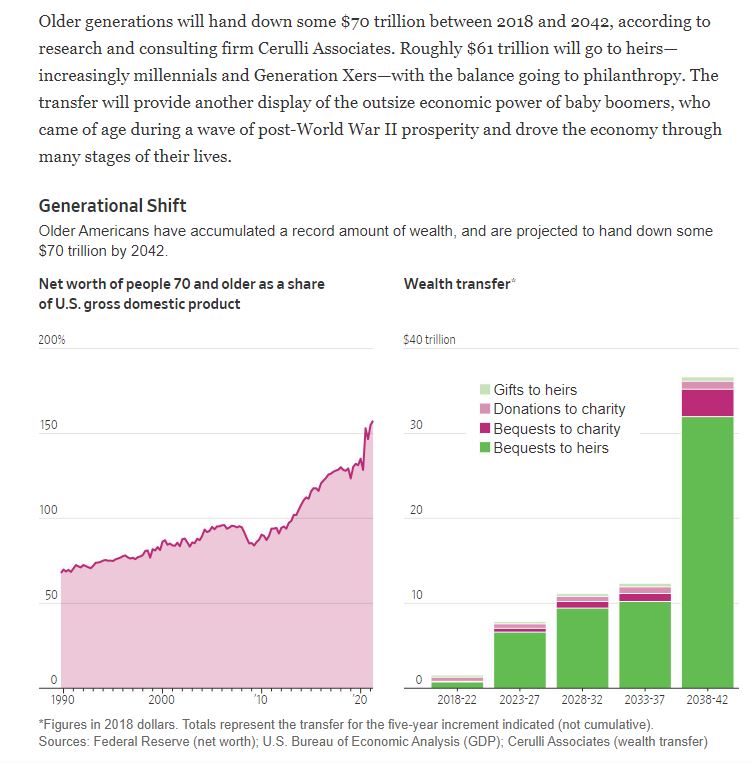

Compare the 2018-2022 era to what is expected to take place in excess of the future 20 a long time (chart previously mentioned).

And then there’s this:

It is hard to figure out particularly how several purchasers are obtaining aid from their mother and father, in aspect mainly because couple are ready to examine how they are shelling out for a new residence. But monetary advisors say they’ve found a wave of extremely-wealthy parents looking for tips on acquiring residences for their youngsters since of the amplified present and estate tax exemption.

The Tax Cuts and Employment Act doubled the amount of money that Individuals can go on to heirs tax-absolutely free, to about $12 million for men and women and $24 million for couples in 2022. It will sunset at the conclusion of 2025, when the exemption is scheduled to be minimize in 50 percent.

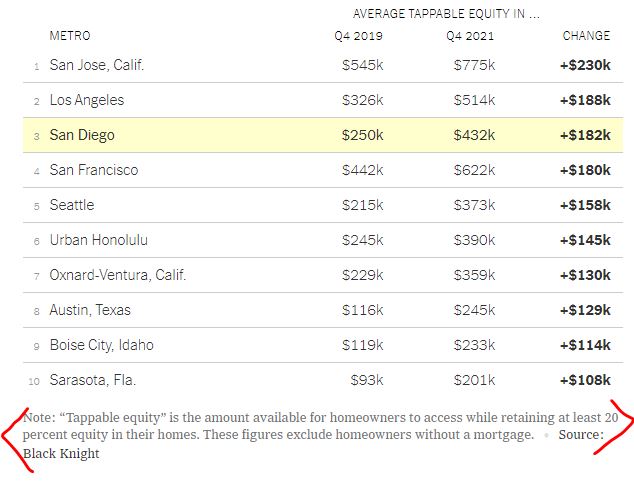

It is not just for the ultra-rich possibly. Each individual homeowner has picked up ample extra property equity lately that they may possibly discover a way to faucet into it to support out their young children:

Sad to say, the generational prosperity transfer will do nothing at all to increase to the supply of residences for sale – it will only develop additional demand of affluent consumers taking part in with income that’s been given to them.

The Fed will be compelled to maintain seeking to manage inflation, and Rob Dawg thinks house loan charges will get as superior as 7.25% (and they could go increased). It will induce an uncomfortable frenzy-transition period of time since the longer it normally takes, the a lot more revenue will be inherited. Yikes!

How extensive will people today hold out-and-see?

Get Good Aid!

[ad_2]

Resource website link