Get Commercial Real Estate Exposure Without the Headaches

[ad_1]

The COVID-19 pandemic did its destruction on professional serious estate amid social distancing measures and function-from-home mandates. With much more workers returning again to do the job, commercial genuine estate could at the time yet again be a practical option.

“The commercial actual estate market was overwhelmed, broken and still left for dead by Covid-19 in 2020,” a Forbes article explained. “It roared back to everyday living in 2021 with record-breaking product sales of $809 billion, but like cops pulling up to a rowdy frat household all-nighter, the arrival of unrestrained inflation and soaring curiosity prices may well signal the party’s about.”

In the existing marketplace atmosphere exactly where inflation is rampant, industrial real estate presents a hedge for buyers. Authentic estate financial investment trusts (REITs) offer you a mounted but adaptable income source in a time when rates keep on to rise.

“Privately owned commercial genuine estate has traditionally supplied a powerful hedge in opposition to inflation,” the article included. “The owners of qualities with brief-term leases this kind of as residences, self-storage, and created house communities can immediately raise rents to match inflation, as measured by the Purchaser Cost Index.”

Get Straightforward Obtain to Professional Actual Estate

1 way to get unfettered entry into the globe of business serious estate is through the Virtus Duff & Phelps Worldwide True Estate Securities Fund. The fund seeks attractive extensive-time period returns by offering world wide authentic estate securities exposure, emphasizing corporations with revenues pushed by recurring rental money.

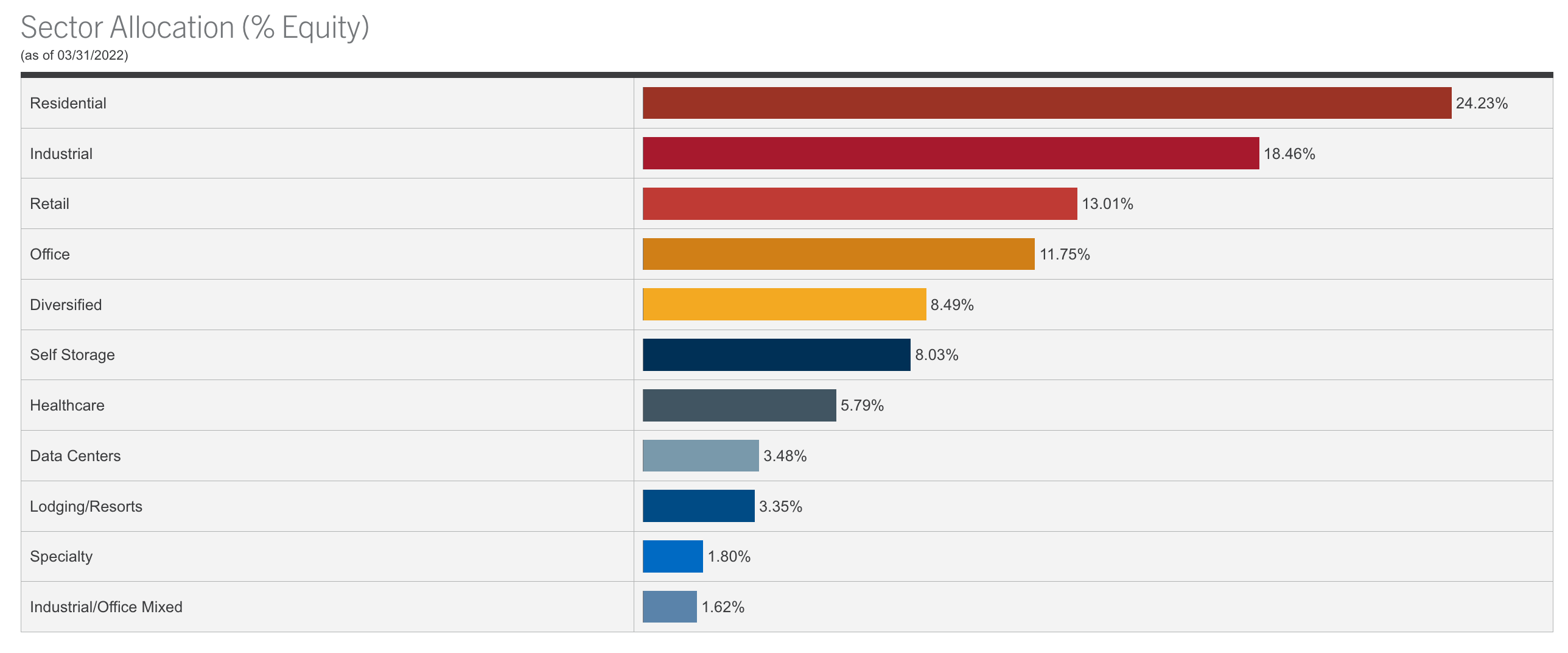

As of March 31, in excess of 30% of the fund is tilted in the direction of residential serious estate. Nevertheless, one more 40% is sprinkled into industrial, retail, and business genuine estate publicity for a diversified portfolio combine.

Alongside with a myriad of market practical experience, the management group of the fund utilizes a disciplined, bottom-up investment decision system, leveraging the two qualitative and quantitative elements while concentrating on higher-high quality business real estate proprietor/operators. This takes all the guesswork out of acquiring traders do all the study them selves to decide specific shares to get international serious estate exposure with a industrial authentic estate slant.

Options of the fund per its solution internet site:

- Interesting money and advancement likely: Pursues the secure funds flows supplied by contractual rental revenues, emphasizing REITs with sturdy management teams concentrated on very long-time period price creation.

- Broadens portfolio diversification: Offers exposure to the lower correlations that the worldwide authentic estate market has historically exhibited to classic stocks and bonds.

- Decreased-volatility strategy: Higher-conviction, lower-turnover portfolio of 50–70 securities strives to benefit from valuation inefficiencies and the traditionally larger prolonged-phrase danger-altered returns of rental assets companies above non-rental organizations.

For extra news, facts, and technique, pay a visit to the Options Channel.

Read through more on ETFtrends.com.

The views and thoughts expressed herein are the views and thoughts of the writer and do not always reflect individuals of Nasdaq, Inc.

[ad_2]

Resource url