Imminentness of Mortgage Infrastructure and Customer Adoption

[ad_1]

[Editor’s Note: Below is the full text of our 216th Weekly Transmission, originally delivered direct to the inbox of more than 500 GEM members on June 15th, 2022.]

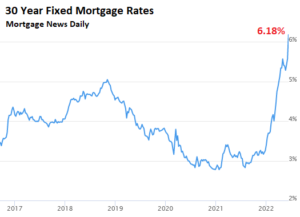

The 30-12 months fixed home finance loan amount is approaching 6%, no doubt catching the rapid focus of both of those the hundreds of thousands of US homeowners with mortgages and aspiring house owners alike. They are now struggling with borrowing fees not found in around a 10 years. For industry vets, it is no surprise—the mortgage loan marketplace is a cyclical a person. And, inevitably, with complicated occasions, will come possibility. Providing technology that tends to make the entire mortgage procedure much more client-helpful, and much more successful for the businesses by themselves, is a huge chance that I’m energized about.

The 30-12 months fixed home finance loan amount is approaching 6%, no doubt catching the rapid focus of both of those the hundreds of thousands of US homeowners with mortgages and aspiring house owners alike. They are now struggling with borrowing fees not found in around a 10 years. For industry vets, it is no surprise—the mortgage loan marketplace is a cyclical a person. And, inevitably, with complicated occasions, will come possibility. Providing technology that tends to make the entire mortgage procedure much more client-helpful, and much more successful for the businesses by themselves, is a huge chance that I’m energized about.

Now is the time for property finance loan engineering companies to gain traction, and for prospects to adopt technological innovation when they have the bandwidth to apply it. Players in the mortgage company working with their time correctly now to de-risk long run cash flows currently transaction-dependent will be in a powerful posture during the following major boom with state-of-the-art, nicely-tested, and economical new procedures in area.

MOMENTUM Making

In 2021, 6.12 million present residences have been transacted, according to NAR—the greatest given that 2006. On prime of that, numerous people refinanced their houses to lock in decreased prices. It was mayhem. The past year also ushered in a wave of exciting new technological innovation startups (e.g. Braid, Pine, Willow Servicing) tackling each individual location of the house loan procedure, from entrance close (originating, underwriting, and closing) to the again end (servicing and capital marketplaces). And the need was there!

But the frenetic rate unearthed a thing broken in the home finance loan business. Numerous human processes, from underwriting all the way to loan profits, are merely not scalable.

The sheer volume of activity about these final two several years underscored the deep have to have for new technologies, but with this sort of quantity flowing by way of the method, few lenders had time to undertake and integrate new technological innovation. The existing systems could possibly have been damaged, but they were a acknowledged quantity, and they labored.

Now it is 2022. With charges greater than they’ve been in a 10 years and the refinance sector dropping off a cliff, we’re looking at layoffs throughout the board (eg. Tomo, Much better, Wells Fargo, KW Mortgage loan, Knock). But in a cyclical field, this is not a surprise (and it is not the first time this has occurred).

As a final result, this is the 12 months for technological know-how targeted on property finance loan infrastructure to finally make procedures a lot more economical and streamlined. Primarily based on discussions with builders in the space, lenders are additional completely ready than at any time to obtain and undertake these solutions.

A popular small business design in the household serious estate place is to take a proportion of the household transaction value, or a proportion of the mortgage, or a payment for every mortgage. The down cycle will see a force toward predictable earnings streams (like recurring subscriptions) versus transaction income.

In instances when volume is high, this company model is desirable and was the immediate trigger of massive earnings advancement in the home loan sector very last 12 months. The challenge is that when volumes fall (i.e. when refinances stopped) so does revenue, which final results in organizations likely via layoffs merely in purchase to manage money move.

A THREAD OF CERTAINTY

This cycle isn’t astonishing in the perfectly-recognized mortgage loan business, but in the enterprise tech globe, cyclical revenues can be difficult. And layoffs, regardless of business norms, affect morale and exterior signaling to consumers/traders and likely hires, specially as corporations elevate external funds just about every 1-2 decades. For that reason, a press to a recurring membership income model for tech-based firms serving the home finance loan industry is interesting. Creating a diploma of predictability into your business design may well not outcome in the steep “up and to the right” developments most corporations in this market place observed past 12 months, but will guarantee regulate of its functions.

A vary of firms are currently creating persuasive options in this space—Reggora, Vesta, Polly, Haven and Stavvy to title a several. That stated, and as extraordinary as the shift has been, the possibility to construct really match-transforming engineering for the mortgage loan sector is much better now than at any time. And the demanding marketplace dynamic will be a forcing functionality to discover genuine product-marketplace healthy.

the GEM BRIEFING

A Non-public Group OF Impartial THINKERS, Free FROM SPONSORED MESSAGES, Sales PITCHES AND Sound

There are 4 sections to membership:

Wonderful Things ARE Taking place

- Transmissions and Radars have turn into a trustworthy signal for market information and analysis.

- Articles or blog posts and concepts are consistently reviewed in solution & system meetings.

- Our digital workgroups convey with each other a various blend of C-Suite execs to focus on true difficulties.

- We’ve launched associates to new suppliers, associates, and mates.

With a mission to bring in the 1,500 most ahead-considering, and varied, innovators, we’re looking for the greatest and brightest in all the land...

Membership is $139 / quarter

Prepared TO Be a part of Appropriate NOW?

NOT Fairly All set?

[ad_2]

Supply backlink