Opportunity Zones Aren’t Perfect, But New Reforms Should Help

[ad_1]

You don’t have to be a political news junkie to know there aren’t many things in the U.S. Congress that get bipartisan support lately. But the Opportunity Zone program is one piece of legislation that has brought legislators together. The program was passed in 2017 as part of the Trump administration’s larger tax reform package. Opportunity Zones are one of the few things Presidents Biden and Trump have agreed on, and real estate professionals and some policy experts tout its positive effects. But Opportunity Zones haven’t been without controversy, as some critics complain its impact on helping disadvantaged communities has been uneven and could even have damaging effects.

The Congressional goodwill on Opportunity Zones is essential because reforms to the program could be on the horizon, the first substantial update since its inception in 2017. The OZ program enables investors to invest capital gains in Qualified Opportunity Funds within 180 days and then defer the tax on those gains until December 31, 2026. The program also allows any appreciation of investments held in qualified funds for longer than ten years to be tax-exempt.

Opportunity Zones were designed to help spur investment in low-income areas nationwide, but the major criticism has been the lack of transparency and reporting requirements. The incentive has attracted investment in multifamily housing, renewable energy, self-storage, and other projects. According to surveys and estimates, most OZ projects are real-estate focused.

The original version of the Opportunity Zone Program section of the tax bill included reporting requirements, but some rules had been stripped away during budget reconciliation. Without that transparency, many have raised concerns the program allows wealthy investors to avoid significant taxes without actually accomplishing the purpose of the legislation, helping disadvantaged areas.

Reform and revitalization

A report from the U.S. Government Accountability Office (GAO) in 2021 was the impetus for the proposed reforms. The report revealed that more than 6,000 qualified OZ funds invested about $29 billion in properties and that about 18,000 taxpayers made investments in Opportunity Zones in 2019 alone. What raised some peoples’ ire was that GAO found specific projects would’ve happened even without the tax incentives offered by the program.

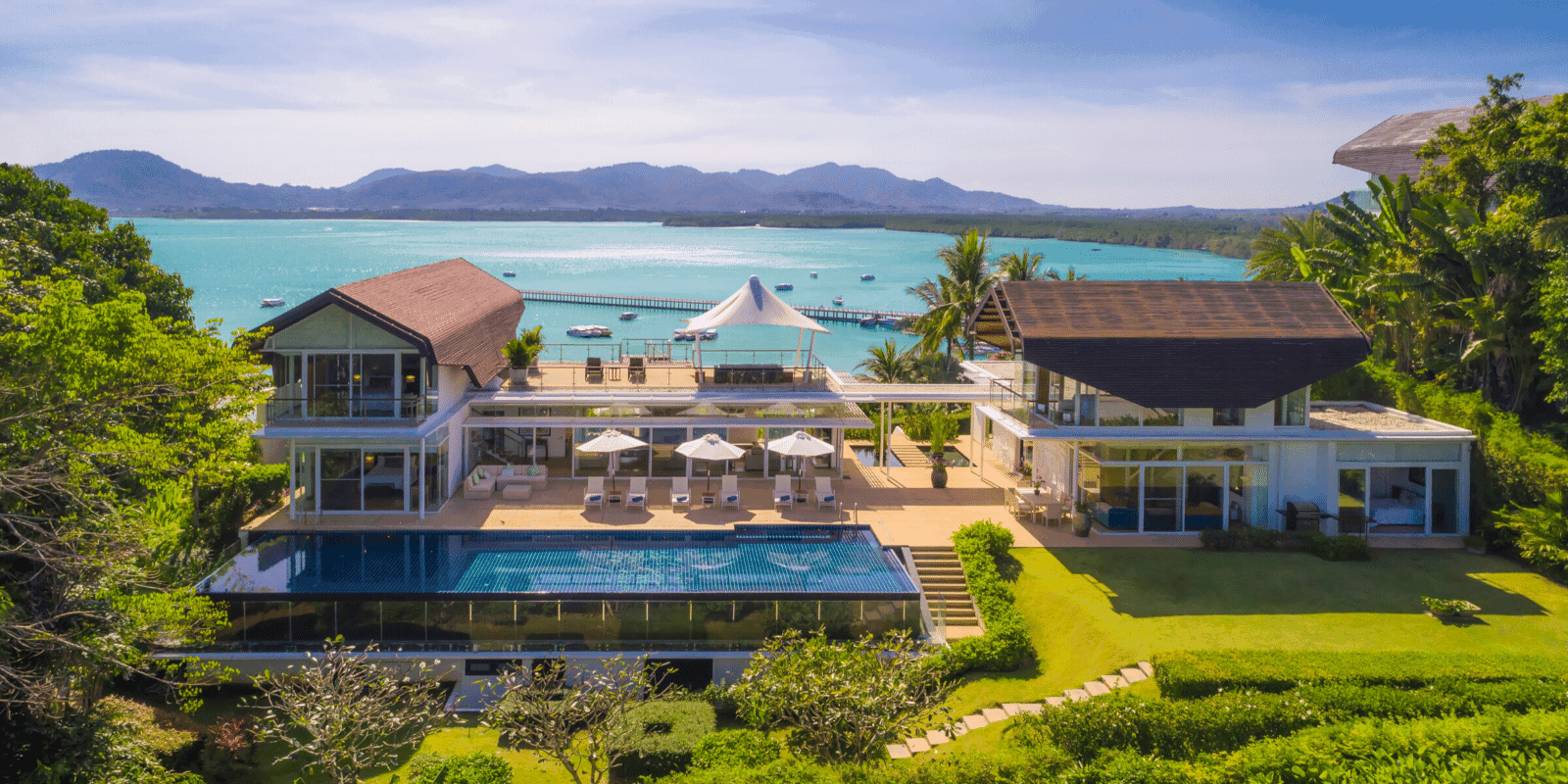

Senator Ron Wyden of Oregon saw the GAO report and swiftly launched an investigation into the effects of Opportunity Zones funds. Wyden was concerned, as were others, that the program’s lack of transparency was allowing wealthy investors to use it to subsidize luxury real estate projects. Which did, in fact, happen. Senator Wyden called out one specific project, a superyacht marina in Palm Beach, Florida, that reportedly included two luxury waterfront apartment towers with a heated pool and private pools on penthouse floors. Clearly, the Opportunity Zone tax incentives weren’t intended for these types of projects.

See Also

In April, Senator Wyden introduced legislation with a bipartisan group of other senators and representatives to reform the Opportunity Zone program, requiring annual public information reporting and annual statements from fund investors to the IRS. The legislation would also prohibit OZ funds from investing in casinos, stadiums, and luxury apartments. The reforms would tighten rules to ensure the incentives program is only available for investments in low-income communities.

While all this may seem like a crackdown on widespread malfeasance, it’s not. Instead, many argue that the OZ Program has been beneficial and met many of its goals, and real estate experts say the reforms are good news for investors. “The legislation has strings attached because of the reporting requirements, but it extends the tax benefits,” said Nicole Elliot, Partner at Holland & Knight. “It’s a revitalization of the program.” If passed, Elliot explained the law would extend the capital gains tax referral for another two years, from 2026 to 2028. The law would also lower the additional 5 percent step-up basis requirements from 7 to 6 years.

The OZ program passed in 2017, but it took until 2019 to finalize the regulations. Many investors thought they lost two years, so the program should tack on an additional two years to make up for the time lost. The legislation would allow states to replace and designate new Opportunity Zones, sunsetting certain census tracts that aren’t impoverished. Real estate experts who have seen the legislation say the reporting requirements aren’t overly onerous for funds and investors. And with the additional two years to defer capital gains taxes, the net result will be more capital flowing into low-income areas. The proposed reforms would also provide $1 billion to be allocated to pay for technical assistance to help states support OZ investments.

The jury’s still out

Like many, Elliot of Holland & Knight said without the transparency and reporting requirements. It’s been challenging to determine how successful the Opportunity Zone program has been. When legislators passed the law, states had to nominate census tracts as OZs, but the process was rushed, according to Elliot. But not everyone agrees with her assessment about not having enough data. “There’s still a ton of data at the census level for Opportunity Zones,” said Jill Homan, President of Javelin 19, a Washington, D.C.-based real estate investment firm with a heavy focus on OZs. “The intent of the new reporting requirements is to isolate the data on a project basis, but we’re not flying blind. We do have some data.”

In 2020, the White House estimated that between $75 billion to $100 billion had been invested in OZ funds since the inception of the program. More than 8,700 areas in the U.S. have been designated by states and certified by the Treasury Department as Opportunity Zones. That encompasses about 10 percent of the U.S. population and 12 percent of all land nationwide. The White House Council of Economic Advisers also said in 2020 that the zones had created half a million jobs.

Still, the overall analysis of the effects of Opportunity Zones from numerous sources is decidedly mixed. Most state governments have differing views on their impact. GAO’s report surveyed states’ responses to the incentive, and 20 states said Opportunity Zones had had a net positive effect. However, 10 states said the impact had been net neutral, and another 20 states said they weren’t sure. “The IRS faces challenges in implementing these plans,” GAO’s report said. “Specifically, the plans depend on data not readily available for analysis.”

Other analyses show Opportunity Zone census tracts are at least being selected correctly and that most qualified zones are, in fact, impoverished areas. About 7.5 million Americans residing in these zones live in poverty, and the zones have an average poverty rate of 26.4 percent compared to the national rate of 13.4 percent, according to the Economic Innovation Group. Opportunity Zones only cover one-quarter of the nation’s low-income census tracts, but they cover nearly half of all census tracts that have been persistently poor since at least 1980.

The Economic Innovation Group’s analysis showed Opportunity Zones also have several other characteristics of distressed communities, such as less access to full-service grocery stores and more adults without a high school diploma than the national average.

But researchers from the Brookings Institute said in 2021 that the Opportunity Zone tax break appears to have a scant impact on boosting economic activity in disadvantaged communities thus far. Wages have slightly increased in the zones, but gains aren’t statistically significant, according to a study from the NYU Stern School of Business.

The study also revealed that investments boosted employment and reduced poverty, but those findings weren’t statistically significant. Most of the improvements were in line with long-term economic trends. “I think we have a fair amount of evidence that these things have fairly muted impacts, at least given what we’ve seen so far,” said Edward Glaeser, an economics professor at Harvard University.

Who is it helping, really?

Some critics say the investments in Opportunity Zones don’t help the people they’re intended to help and, in some cases, can accelerate a trend of gentrification. For example, in one Denver neighborhood, several OZ investments included a hotel and conference center, Class A office space, and luxury residences. Some residents in Denver questioned whether these real estate investments were designed for them or a sign that the “up-and-coming” neighborhoods would eventually price them out.

The problem, for now, is that Opportunity Zones investments have little strings attached. The legislative reforms would change that, but as it currently stands, investments can be in anything from five-star hotels to data centers. These things create jobs and spur economic activity in distressed areas, but they’re not necessarily the projects that help people in the communities the most.

Another example in Denver is a planned development in the Elyria-Swansea neighborhood, where investors are redeveloping an old, vacant AT&T call center. The project has drawn scrutiny from residents, and some of them have flocked to Denver City Council meetings to express concern. The investors plan to turn the abandoned office park into apartments, townhomes, restaurants, and, among other things, retail space. Community groups and the investors are negotiating, and the community doesn’t oppose the project per se, but issues continue to crop up.

See also

The investors agreed to set rents in 70 of the planned apartments at 60 percent of the area’s median income, and they also will set aside retail space for local businesses. But the neighborhood activists want more. They’re asking for twice as many affordable units, for local businesses to get the first chance to lease affordable space, and for the developers to pay into a property tax relief fund. Plus, activists say there’s no guarantee the project will hire locals for construction work or that the development will help the community in other ways.

Without more strings attached to the program, OZ investments can still spur activity in distressed communities. Still, the question of whether the program is really helping the people the program is supposed to serve remains. Denver City Councilwoman Candi CdeBaca says the program is just the most recent example of failed urban renewal and a throwback to federal policies of the 1950s and 1960s that sped up gentrification in disadvantaged neighborhoods. “It’s a new iteration of something that’s existed repeatedly throughout time to really colonize areas,” she said.

Steps in the right direction

Not everyone has such a harsh view of Opportunity Zones, though. Homan of Javelin19, an Opportunity Zone-focused investment shop, is a huge proponent of the OZ program, calling it “one of the most significant incentive programs in a generation.” Since 2018, Homan has become an expert and advocate for Opportunity Zones, even testifying at IRS OZ hearings in 2019. She also publishes an Opportunity Zone Outlook newsletter, which gathers extensive information for investors.

Homan said the program has been very effective at investing in disadvantaged communities, and there has been significantly more capital invested than other economic development initiatives. “When you dig in and look at the projects, it’s really positive,” Homan said. “Opportunity Zones aren’t designed to cure poverty; it’s just one step in the right direction.”

See Also

She added that some media outlets had demonized OZs as just a tax break for the wealthy, not too different than their view on 1031 exchanges, but that’s not necessarily true. People bring up the negative press for OZs to her a lot. She tells them that a bipartisan coalition of members of Congress and senators, including Democratic Senator Cory Booker, signing up to promote the program is evidence that it has produced good results.

For every example of a troublesome OZ investment, there are examples of ones that are beneficial to distressed communities. For example, in Erie, Pennsylvania, OZ funds have been the engine for $40 million of projects, including 140 residential units and a full-service grocery store in a designated “food desert,” defined as a low-income census tract without a grocery store within a 1-mile radius in an urban area. In South Los Angeles, SoLa Impact group used OZ funds to build a business campus covering 90,000 square feet of commercial space. The campus includes the first Black-owned craft brewery in California, a Black-owned art gallery, and a Technology and Entrepreneurship Center.

Progress, not perfection

No matter how people feel about the Opportunity Zone program, real estate investors anticipate the proposed reforms. Homan said most investors would like to see the legislation pass, and President Biden supports it. The problem is that Congress is running out of time to pass the law before their current session expires. But even if the bill isn’t passed this year, the same group of lawmakers would probably be interested in passing it next year. “I’m equally encouraged about the reforms passing, whether it happens now or later,” Homan said. The broad-based support for the reforms means they could pass even in this lame-duck year for Congress.

Despite some criticisms, investors say the big picture of the OZ program is mainly positive. It’s a situation where policymakers, legislators, and investors shouldn’t let the perfect be the enemy of the good, says Ira Weinstein of the advisory firm CohnReznick. There have been situations where the program has been abused, but plenty of other cases where it’s led to positive results. The proposed bipartisan reforms will strengthen the OZ program, empowering the Treasury Department to ensure it provides economic and social benefits and achieves its goal. The reforms, if passed, will also provide more transparency and data so we can further analyze Opportunity Zone impacts.

It’s tempting to take a negative stance against Opportunity Zones, but we should also note how young the program is. Like other government urban renewal programs, it will take time to work out the kinks. Investors welcome the reforms for several reasons, including an extra two years for the capital gains tax deferral period. The reforms have bipartisan support, which is rare in this day and age. Controversies and criticisms of the OZ program will likely continue, but that shouldn’t stop investors from considering projects. Opportunity Zones are not a perfect piece of tax legislation, but the efforts to improve them mean it may eventually benefit everyone.

[ad_2]

Source link