Q2 2022 Northern California Real Estate Market Update

[ad_1]

The following investigation of select counties of the Northern California serious estate market place is offered by Windermere Authentic Estate Main Economist Matthew Gardner. We hope that this details might aid you with earning better-educated authentic estate selections. For further info about the housing market place in your area, make sure you never wait to call your Windermere True Estate agent.

Regional Economic Overview

Above the previous 12 months, the Northern California marketplaces covered in this report additional 184,600 positions. With good career expansion, the unemployment level fell to 2.4%, which is a major fall from the 5.8% fee we observed a calendar year back. The most affordable jobless level was in Santa Clara County (1.8%), and the highest amount was in Solano County, where by 3.5% of the workforce continues to be unemployed.

Northern California Residence Profits

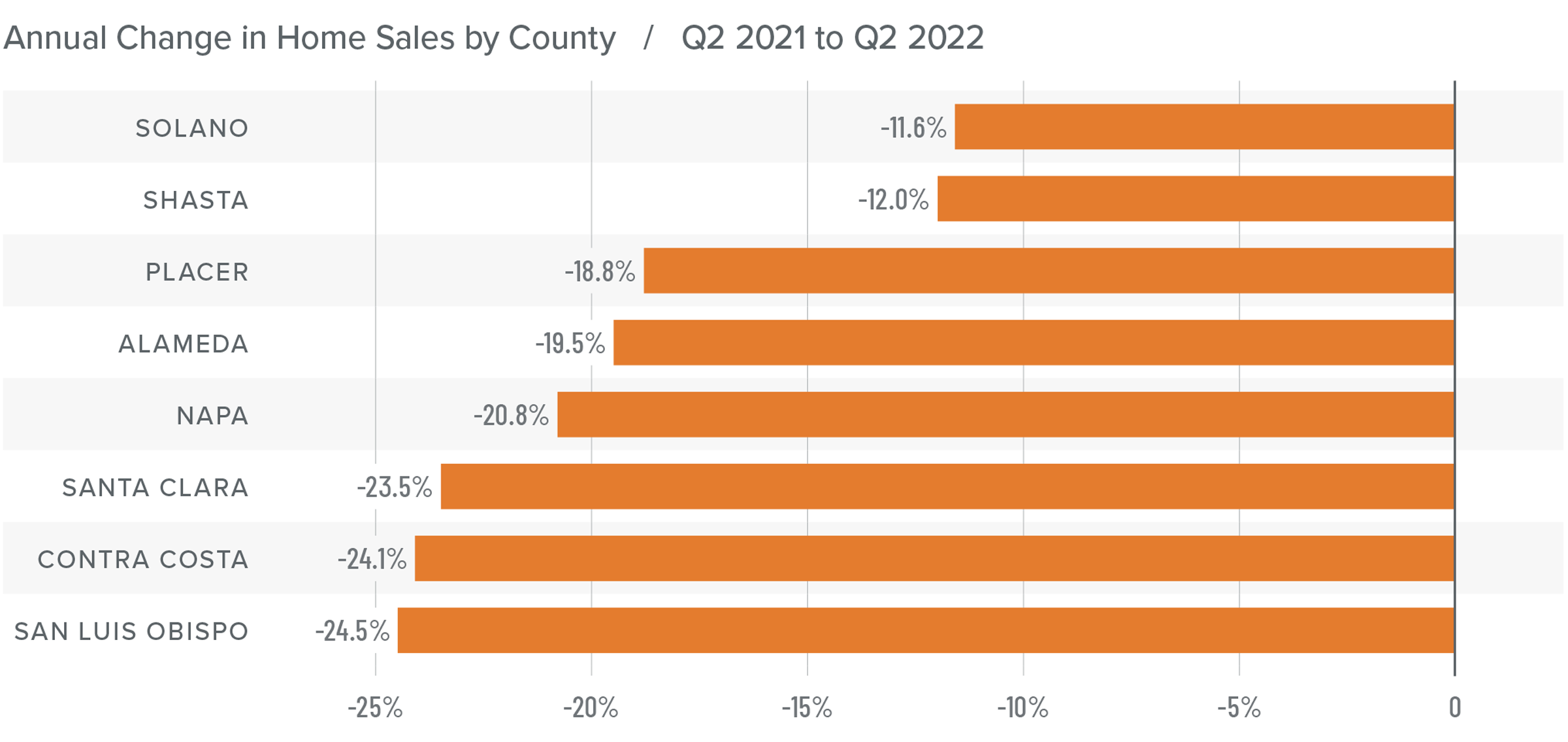

❱ In the 2nd quarter of 2022, 14,235 houses bought, which is a drop of 21.1% when compared to a calendar year back. Revenue rose an spectacular 37.6% in comparison to the very first quarter of this yr.

❱ Yr in excess of yr, product sales fell across the board. The greatest fall was in San Luis Obispo County. Solano and Shasta counties experienced fairly modest declines.

❱ The amount of properties for sale jumped more than 67% in contrast to the initial quarter of the 12 months. This advancement in stock has induced an amazing increase in revenue.

❱ Pending household product sales ticked up from the initially quarter of 2022, suggesting that we may well see some expansion in closings in the 3rd quarter of this year.

Northern California House Charges

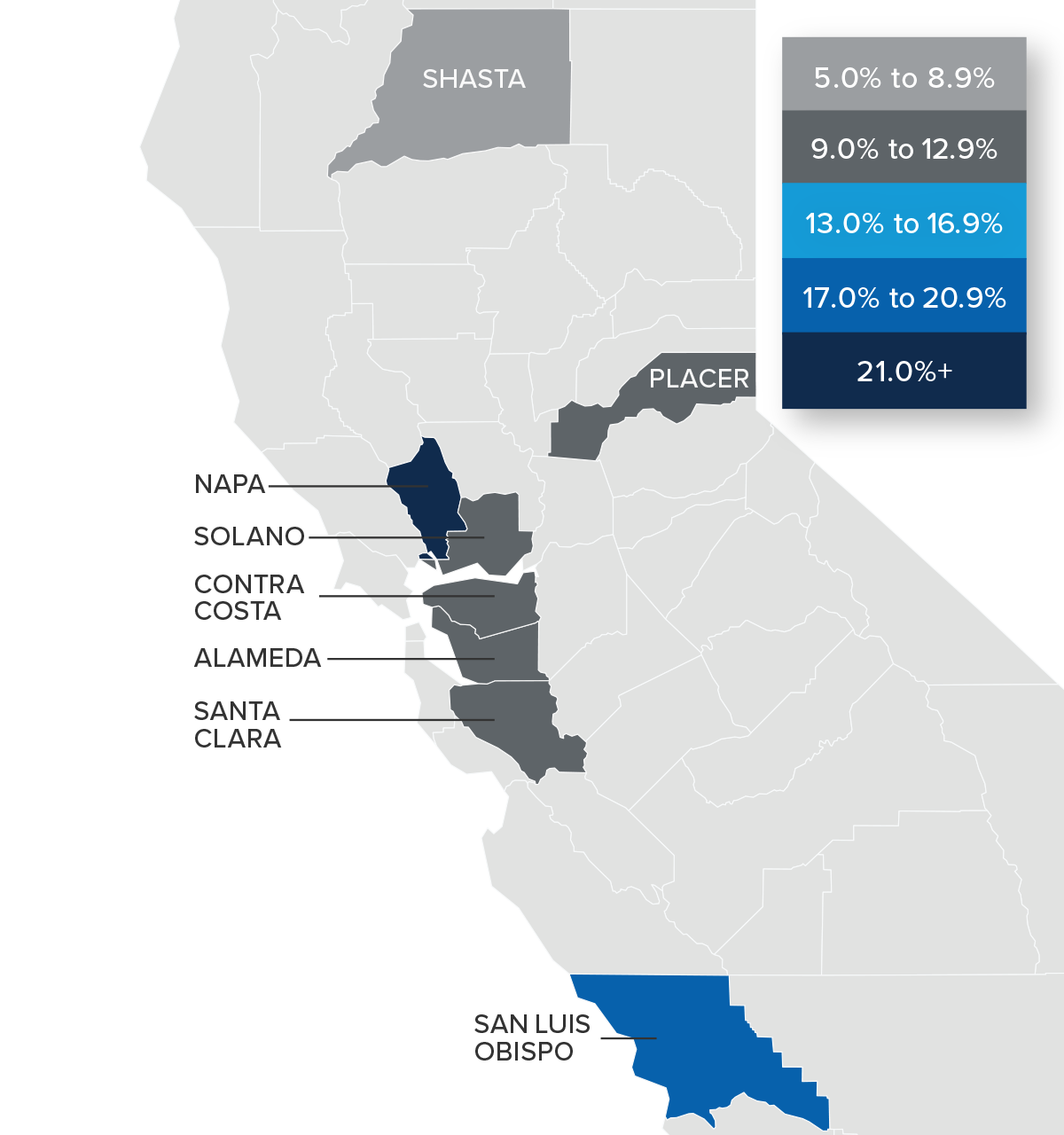

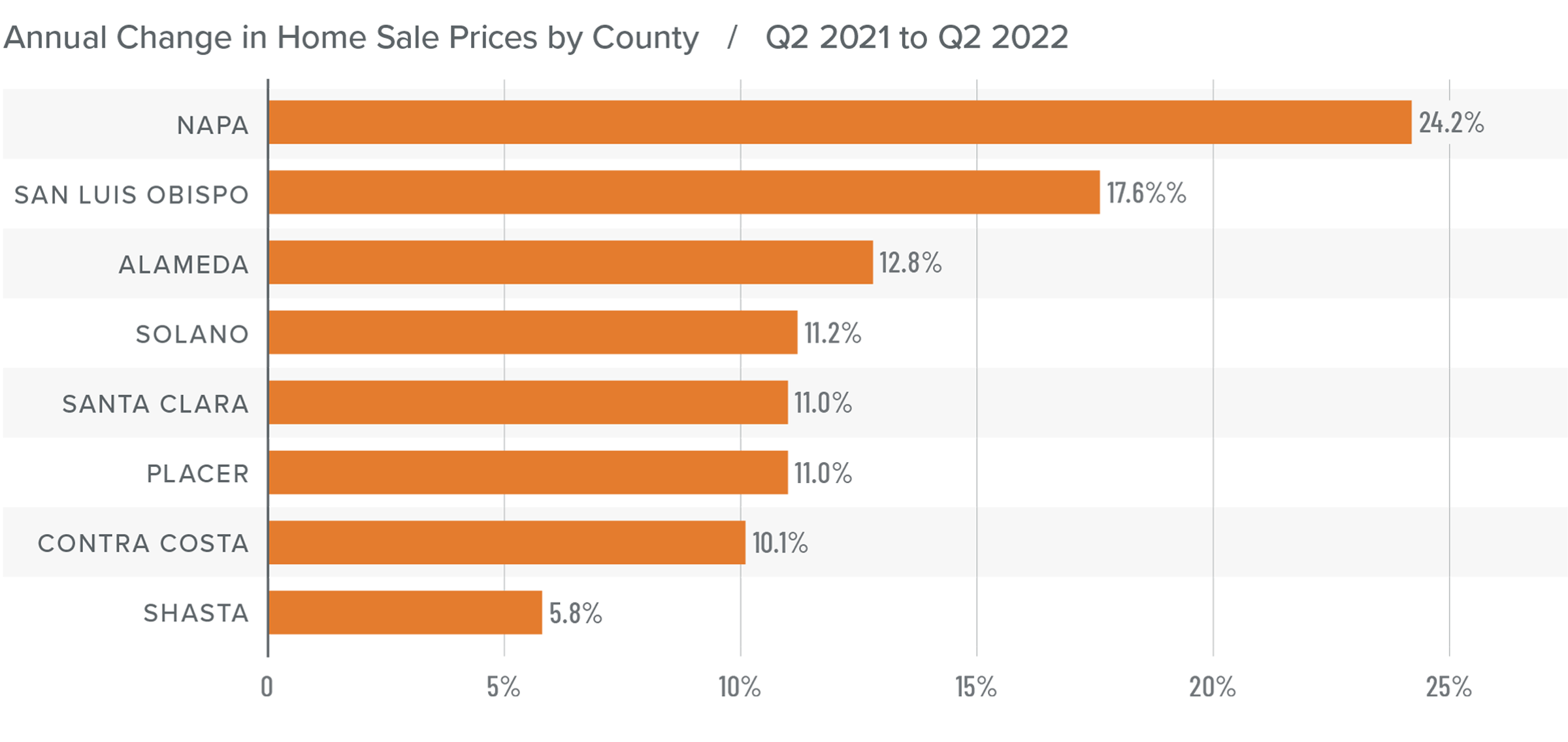

❱ The typical property selling price in the location rose 10.6% from this time final yr to $1.35 million. Compared to the closing quarter of 2021, charges rose by 11%.

❱ I have begun watching listing prices, as they will be a top indicator of regardless of whether the sector is starting up to experience the impacts of declining affordability because of to growing financing charges. In the next quarter, the median listing cost in the location rose an typical of 13%. We did see a little drop in Placer County, but I am not overly anxious as it is a pretty little area that can knowledge abnormal swings in both listing and sale rates.

❱ Sale costs rose by double digits in all counties other than Shasta when compared to a yr in the past they were being also higher across the location compared to the very first quarter of the 12 months.

❱ Even with rising stock amounts and bigger financing costs, the market place seems to continue to be buoyant. Nevertheless, the speed of cost expansion has slowed, which will likely continue as the location starts to transfer towards a much more balanced marketplace.

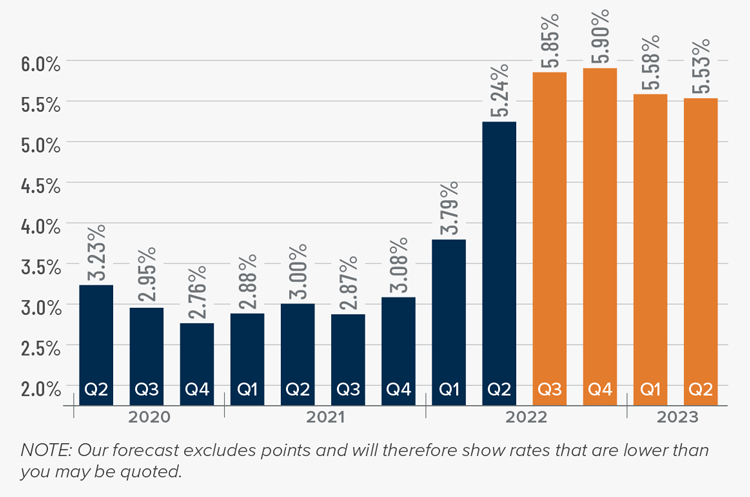

Property finance loan Prices

Although house loan prices did drop in June, the quarterly trend was even now going greater. Inflation—the bane of bonds and, as a result, home finance loan rates—has yet to slow, which is putting upward strain on financing charges.

That reported, there are some indicators that inflation is starting off to soften and if this commences to clearly show in future Buyer Rate Index numbers then rates will most likely discover a ceiling. I am hopeful this will be the circumstance at some place in the third quarter, which is mirrored in my forecast.

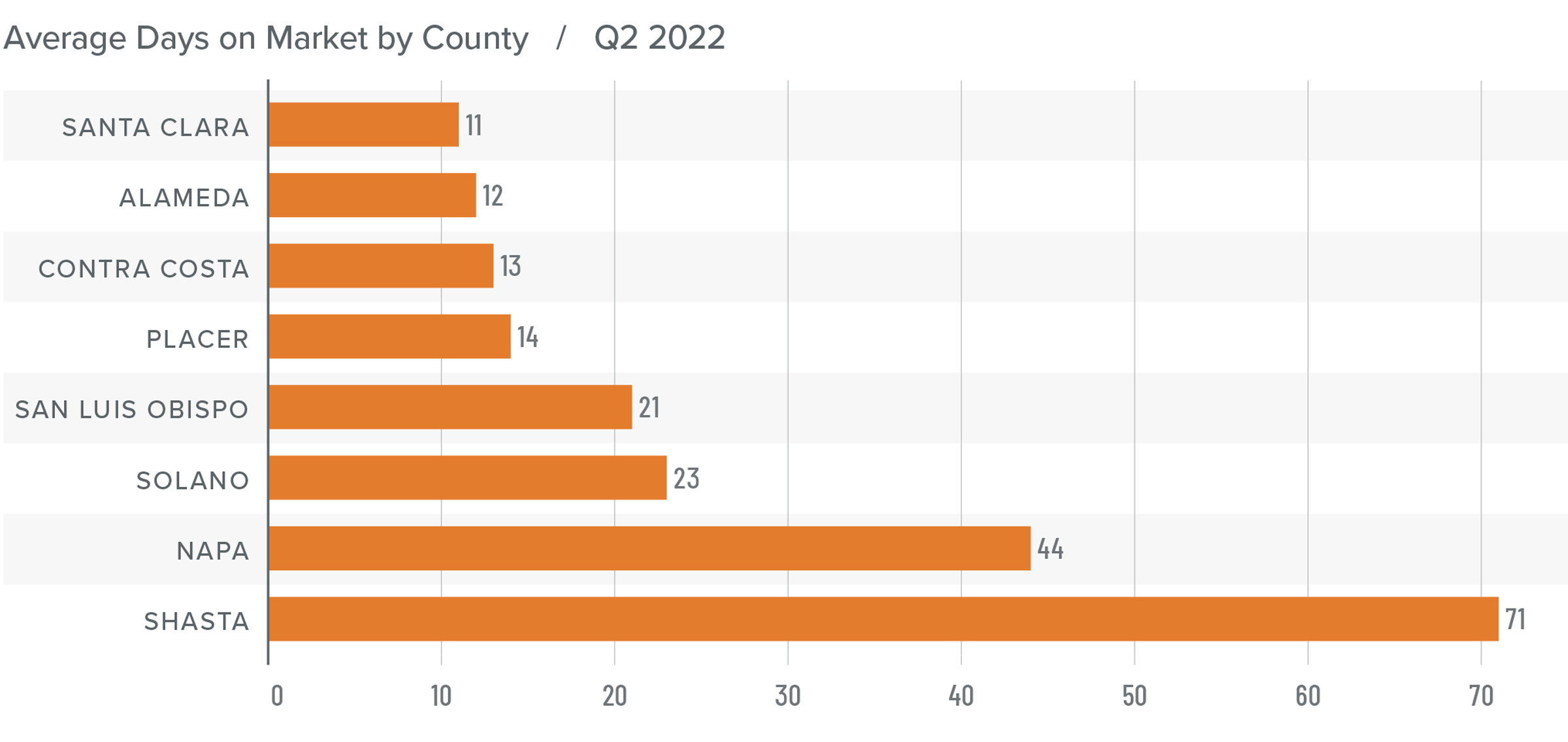

Northern California Times on Current market

❱ The regular time it took to market a home in the Northern California counties in this report dropped two times when compared to the 2nd quarter of 2021.

❱ The quantity of time it took to provide a house fell in Napa, Santa Clara, San Luis Obispo, and Shasta counties, remained static in Alameda and Solano, and rose modestly in Contra Costa and Placer counties. Regular market place time fell in all counties other than Solano and Shasta when compared to the first quarter of 2022.

❱ In the next quarter, it took an average of 26 days to sell a residence, which was seven much less days than in the initially quarter of this calendar year.

❱ The best drop in current market time from a year in the past was in Shasta County, where by it took seven fewer days to market a property.

Conclusions

This speedometer reflects the point out of the region’s true estate market place applying housing stock, value gains, property sales, interest premiums, and larger financial aspects.

Optimistic career development and a expanding overall economy keep on to promote the housing sector, which has led dwelling sales and price ranges to increase even as home loan charges and supply ranges jumped. While affordability carries on to be a substantial problem, there are no indications that a main correction is imminent. Nevertheless, we are observing the speed that houses market starting to sluggish, as is the speed of selling price development. This indicates to me that the sector is starting to interesting. That reported, with ordinary listing prices in most counties continuing to rise, sellers keep on being assured.

All factors thought of, I have left the needle in the exact same posture as in the initially quarter of the 12 months. The market place continue to favors dwelling sellers, but increasing stock concentrations and slowing rate growth counsel they are not in a far better place now than they had been at the start of the calendar year.

About Matthew Gardner

As Main Economist for Windermere True Estate, Matthew Gardner is responsible for analyzing and deciphering economic information and its effects on the actual estate marketplace on both a neighborhood and nationwide stage. Matthew has in excess of 30 a long time of professional knowledge both equally in the U.S. and U.K.

In addition to his day-to-day duties, Matthew sits on the Washington Point out Governors Council of Economic Advisors chairs the Board of Trustees at the Washington Heart for Authentic Estate Investigation at the University of Washington and is an Advisory Board Member at the Runstad Heart for Actual Estate Research at the College of Washington in which he also lectures in actual estate economics.

[ad_2]

Source backlink