The Hottest Real Estate Markets of 2021

[ad_1]

After nearly two years of unprecedented competition, the residential real estate market is finally showing signs of cooling off. While inventory remains at low levels and demand is still high, home sales and home price growth have begun to slow this spring.

One of the primary reasons for the decline in demand is the increase in interest rates for mortgage loans. At the beginning of the COVID-19 pandemic, the U.S. Federal Reserve launched aggressive stimulus measures to stave off an economic downturn, which pushed interest rates to historic lows and made buying homes more affordable. But amid concerns about high inflation, the Fed has recently reversed course and begun to raise rates. The average 30-year fixed mortgage interest rate increased from a low of 2.65% in January of 2021 to over 5% now—and could potentially continue to increase over the rest of 2022.

Increased costs of borrowing are discouraging buyers and lowering purchase budgets, especially for those who may not have the income, credit history, or equity to qualify for the lowest rates. But home prices themselves are also a significant factor leading to decreased interest in real estate.

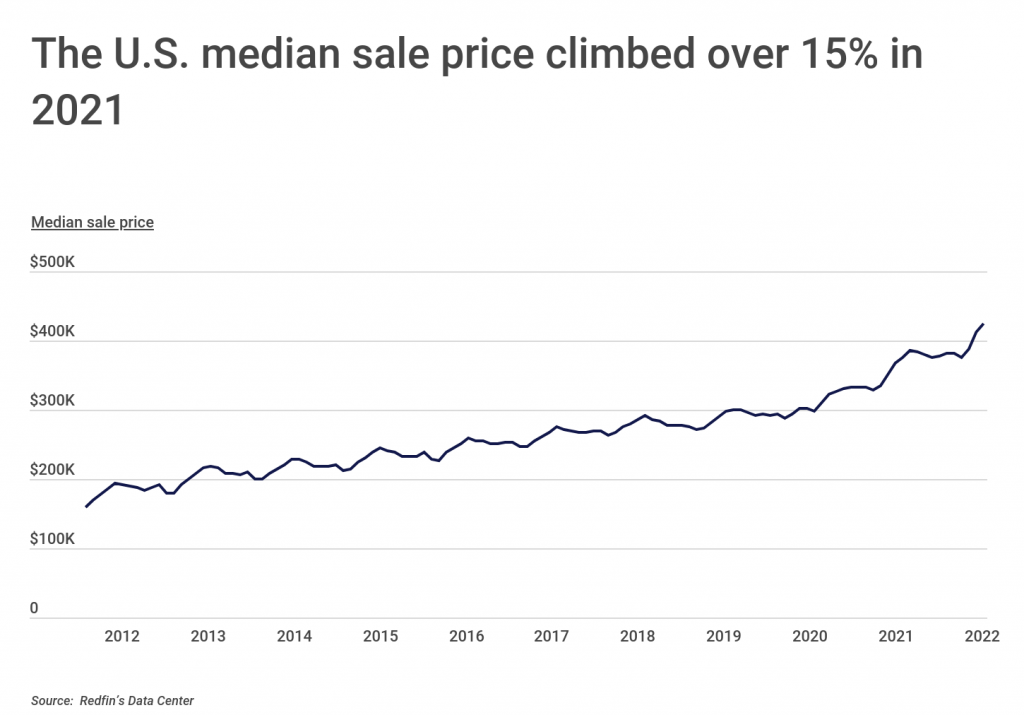

Prices have been on a steady upward trajectory for the last decade, but the leap in prices since the beginning of 2020 has been especially stark. At the beginning of 2020, the median sale price of a home in the U.S. was $288,000, and by the beginning of 2021, that figure had increased by 14% to $329,000. At the start of 2022, the median home price had jumped another 16% to $376,000—and was already up to $424,000 as of April of this year. The pace of these increases has begun to price buyers out of the market, especially first-time homebuyers who have not been able to benefit from home appreciation and whose wage growth or ability to save for a down payment may not be keeping pace with price growth.

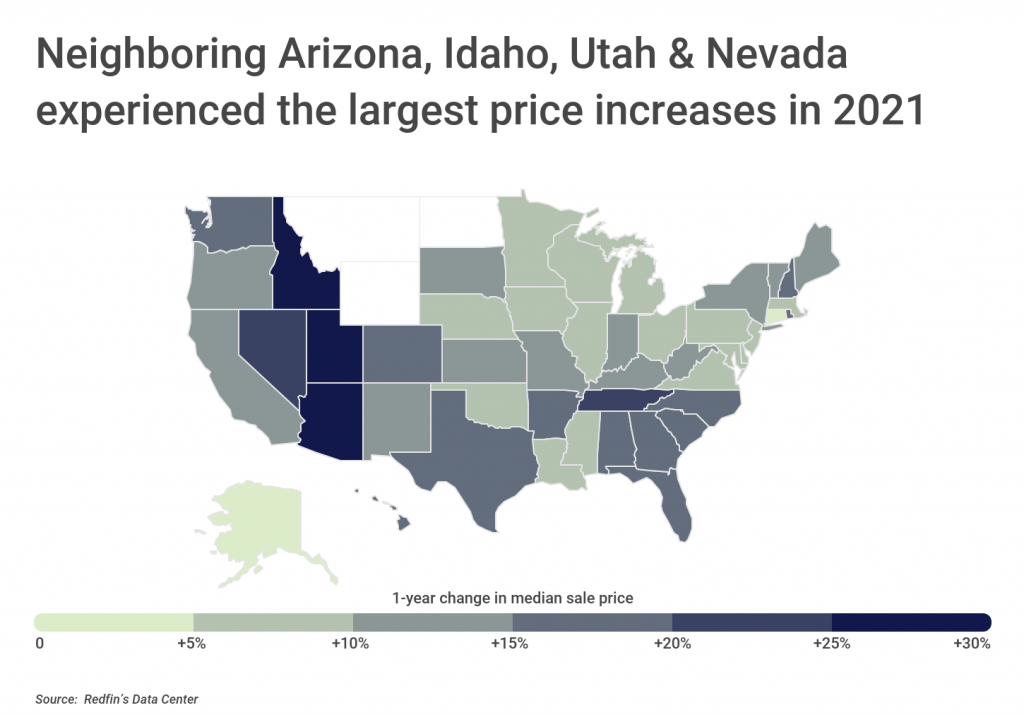

The Mountain West region and the Southeast have seen some of the sharpest increases in home prices. Neighboring Arizona, Idaho, and Utah each saw the median sales price for a home increase by more than 25% in 2021, while Nevada and Tennessee also saw increases of more than 20%. Many of these locations are booming as people leave more expensive states like California in search of more affordable locales—but creating competition and higher prices as a result.

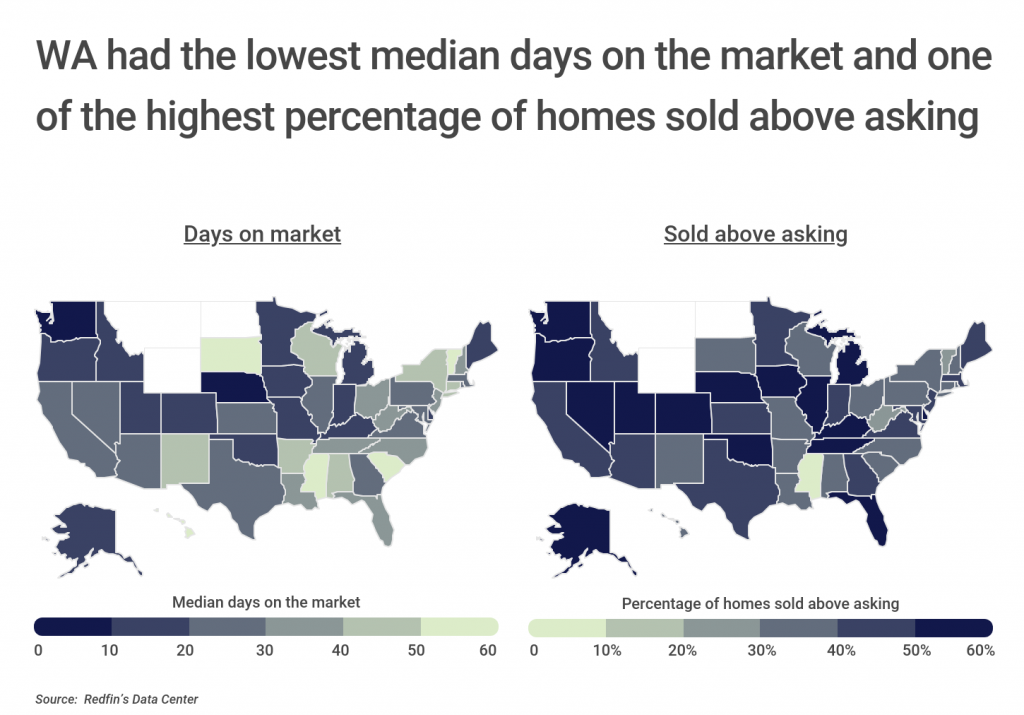

Home prices are just one metric to show how intense the U.S. residential real estate market is. In many locations, homes are both spending less time on the market and selling more frequently above list price. For example, the median home in fast-growing Washington spent 7.8 days on the market in 2021, and nearly three in five homes (58.2%) sold above asking price. Similarly, the median home spent 8.4 days on the market in Nebraska last year, while Alaska led the nation in percentage of homes selling above asking at 60.9%.

The locations with the hottest real estate markets of 2021 share not only fast-increasing prices, but also less time on the market for homes and more homes selling above list price. The cities that share these characteristics are some of the fastest-growing and most economically prosperous parts of the U.S. in states including California, Colorado, and Texas. While the real estate market could be cooling down elsewhere in the U.S., these attractive locations could continue to see high competition—and high prices—into the future.

The data used in this analysis is from Redfin. To determine the locations with the hottest real estate markets of 2021, researchers at Construction Coverage calculated a composite index that considered the one-year change in median sale price, median number of days on the market, percentage of homes sold above asking, and average sale-to-list percentage. In the event of a tie, the location with the greater one-year change in median sale price was ranked higher. With the exception of the one-year change in sale price—which was measured between December 2020 and December 2021—all other statistics reflect January–December 2021 data.

Here are the hottest real estate markets of 2021.

The Hottest Large Real Estate Markets of 2021

Photo Credit: Sean Pavone / Shutterstock

15. Phoenix, AZ

- Composite score: 54.98

- Median sale price: $379,140

- 1-year change in median sale price: +30.3%

- Median days on the market: 26.8

- Percentage of homes sold above asking: 50.5%

- Average sale-to-list percentage: 101.2%

Photo Credit: Bob Pool / Shutterstock

14. Portland, OR

- Composite score: 57.98

- Median sale price: $528,341

- 1-year change in median sale price: +6.9%

- Median days on the market: 10.1

- Percentage of homes sold above asking: 56.5%

- Average sale-to-list percentage: 103.0%

Photo Credit: Lucky-photographer / Shutterstock

13. San Diego, CA

- Composite score: 60.03

- Median sale price: $757,937

- 1-year change in median sale price: +14.5%

- Median days on the market: 11.5

- Percentage of homes sold above asking: 57.4%

- Average sale-to-list percentage: 102.2%

Photo Credit: Radoslaw Lecyk / Shutterstock

12. San Francisco, CA

- Composite score: 60.23

- Median sale price: $1,455,994

- 1-year change in median sale price: +9.3%

- Median days on the market: 24.2

- Percentage of homes sold above asking: 62.1%

- Average sale-to-list percentage: 108.2%

Photo Credit: Roschetzky Photography / Shutterstock

11. Austin, TX

- Composite score: 60.35

- Median sale price: $556,187

- 1-year change in median sale price: +17.9%

- Median days on the market: 32.1

- Percentage of homes sold above asking: 59.5%

- Average sale-to-list percentage: 105.2%

Photo Credit: Andrew Zarivny / Shutterstock

10. Denver, CO

- Composite score: 60.90

- Median sale price: $532,913

- 1-year change in median sale price: +12.5%

- Median days on the market: 7.0

- Percentage of homes sold above asking: 54.1%

- Average sale-to-list percentage: 102.4%

Photo Credit: Timothy Milan Kuret / Shutterstock

9. Fort Worth, TX

- Composite score: 61.15

- Median sale price: $298,230

- 1-year change in median sale price: +25.0%

- Median days on the market: 18.8

- Percentage of homes sold above asking: 53.8%

- Average sale-to-list percentage: 101.7%

Photo Credit: Tim Roberts Photography / Shutterstock

8. Mesa, AZ

- Composite score: 62.43

- Median sale price: $387,210

- 1-year change in median sale price: +30.7%

- Median days on the market: 23.6

- Percentage of homes sold above asking: 55.5%

- Average sale-to-list percentage: 101.8%

Photo Credit: John Roman Images / Shutterstock

7. Anaheim, CA

- Composite score: 63.38

- Median sale price: $751,873

- 1-year change in median sale price: +21.5%

- Median days on the market: 29.6

- Percentage of homes sold above asking: 68.5%

- Average sale-to-list percentage: 102.5%

Photo Credit: Sean Pavone / Shutterstock

6. Raleigh, NC

- Composite score: 64.40

- Median sale price: $357,438

- 1-year change in median sale price: +22.2%

- Median days on the market: 34.4

- Percentage of homes sold above asking: 65.8%

- Average sale-to-list percentage: 103.6%

Photo Credit: Peter Witham / Shutterstock

5. Arlington, TX

- Composite score: 65.33

- Median sale price: $284,259

- 1-year change in median sale price: +20.0%

- Median days on the market: 17.1

- Percentage of homes sold above asking: 61.1%

- Average sale-to-list percentage: 102.5%

Photo Credit: yhelfman / Shutterstock

4. Oakland, CA

- Composite score: 68.15

- Median sale price: $886,746

- 1-year change in median sale price: +2.6%

- Median days on the market: 15.2

- Percentage of homes sold above asking: 77.0%

- Average sale-to-list percentage: 114.5%

Photo Credit: Andrew Zarivny / Shutterstock

3. Sacramento, CA

- Composite score: 74.20

- Median sale price: $452,630

- 1-year change in median sale price: +13.6%

- Median days on the market: 8.9

- Percentage of homes sold above asking: 68.9%

- Average sale-to-list percentage: 103.3%

Photo Credit: Jacob Boomsma / Shutterstock

2. Aurora, CO

- Composite score: 85.65

- Median sale price: $432,727

- 1-year change in median sale price: +23.3%

- Median days on the market: 5.1

- Percentage of homes sold above asking: 68.8%

- Average sale-to-list percentage: 103.4%

Photo Credit: Uladzik Kryhin / Shutterstock

1. San Jose, CA

- Composite score: 86.70

- Median sale price: $1,234,465

- 1-year change in median sale price: +23.3%

- Median days on the market: 11.6

- Percentage of homes sold above asking: 79.0%

- Average sale-to-list percentage: 107.4%

Detailed Findings & Methodology

The data used in this analysis is from Redfin’s Data Center. To determine the locations with the hottest real estate markets of 2021, researchers calculated a composite index that considered the one-year change in median sale price, median number of days on the market, percentage of homes sold above asking, and average sale-to-list percentage. In the event of a tie, the location with the greater one-year change in median sale price was ranked higher. With the exception of the one-year change in sale price—which was measured between December 2020 and December 2021—all other statistics reflect January–December 2021 data. To improve relevance, only cities with at least 100,000 residents were included. Additionally, cities were grouped into cohorts based on population size: small (100,000–149,999), midsize (150,000–349,999), and large (350,000 or more). Note, only locations with complete monthly data available for all fields considered for 2021 were included in this analysis.

This article was first published on LatticePublishing.com.

[ad_2]

Source link