To lower your property taxes, apply for a homestead exemption

[ad_1]

Quite a few householders have by now filed for a homestead exemption to reduce taxes. If you haven’t, do it now.

TEMPLE, Texas — A Typical Residence Homestead Exemption is readily available for anyone who owns their personal home, lived in that property on January 1 of this 12 months, and who did not improve their permeant residence because January 1 of this 12 months.

If you personal your house ideal now, this ought to implement for you. Realtors notify 6 News you really should implement for this exemption proper absent.

A Common Home Homestead Exemption caps the taxable worth of your dwelling from escalating far more than 10 % just about every year.

If a house was valued at $200,000 last year, and the 2022 appraisal place the new price at $260,000, a home owner with this exemption would be taxed at a price of $220,000 as an alternative of the comprehensive $260,000. This is since $220,000 is a 10 % improve from the original $200,000.

The next 12 months, that taxable worth of $220,000 could only raise 10 % more to $242,000, regardless of what the appraised worth was.

If the house owner, sad to say, did not file for a Normal Home Homestead Exemption. They would be taxed on the complete, recently appraised benefit of $260,000 this calendar year.

Realtors generally really encourage homeowners to file the exemption as soon as they are suitable immediately after obtaining a household. A Typical Home Homestead Exemption will also shield a house from becoming forcibly offered by collectors if a house owner information for bankruptcy.

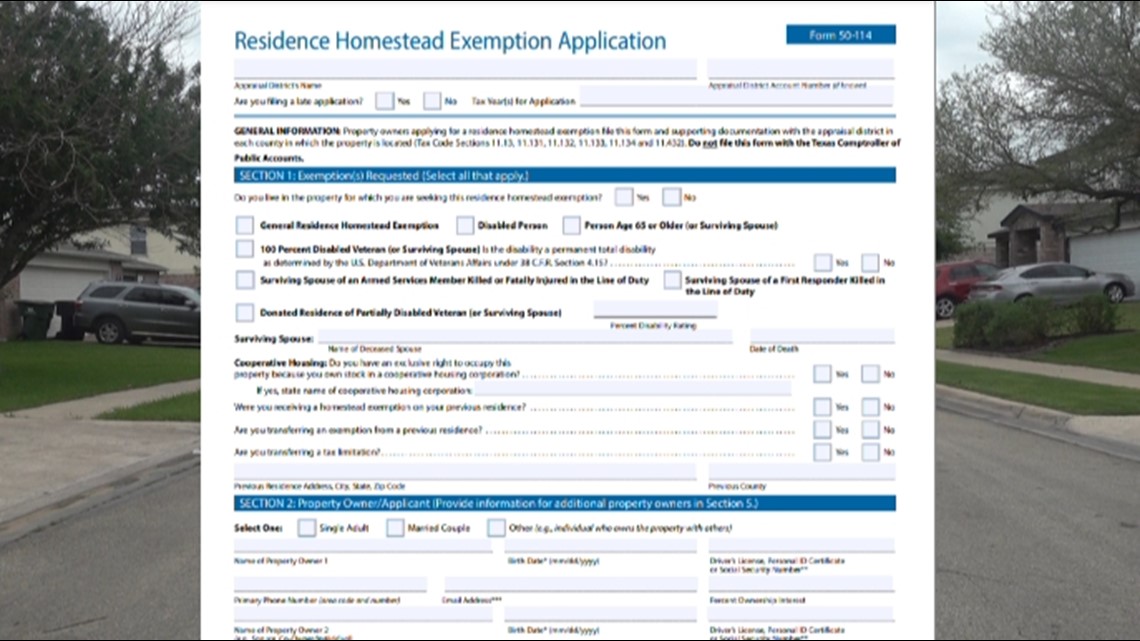

A home-owner can nevertheless file for this exemption this 12 months as well. Simply just down load Form 50-114 here and get that variety to your area tax appraisal district together with a legitimate drivers license. The type could be mailed in with a picture of the driver’s license as very well.

[ad_2]

Supply link