Property Price Growth Slows in June

[ad_1]

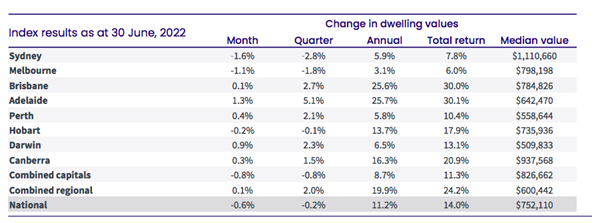

Selling price expansion across the country has continued to sluggish down final month with the hottest CoreLogic Residence Benefit Index (HVI) displaying that values dipped -.6% in June.

The greatest falls were in Sydney and Melbourne, in which values were being down -1.6% and -1.1% respectively even though housing values have been also lower by -.2% in Hobart.

In accordance to CoreLogic, each individual funds metropolis and wide relaxation of state area is now very well previous their peak expansion charge.

Advancement in Brisbane eased to .1% in June, though Adelaide carries on to be the strongest sector in the place with values growing by 1.3%. Progress in Perth’s housing values, which have been temporarily showing a second wind as state borders reopened, are once again shedding steam with values up just .4% in June.

Regional marketplaces have also seen a sharp reduction in development with values only .1% bigger final month.

Resource: CoreLogic

CoreLogic Exploration Director, Tim Lawless, reported the housing market’s sharper reduction in development coincides with the May possibly money charge hike, surging inflation and minimal shopper sentiment.

“Housing worth expansion has been easing due to the fact relocating as a result of a peak in March previous year, when early motorists of the slowdown included soaring set phrase house loan rates, an expiry of fiscal aid, a trend in direction of decreased buyer sentiment, affordability difficulties and tighter credit history ailments,” Mr Lawless explained.

“More a short while ago, surging inflation and a speedily growing income rate have additional even more momentum to the downwards pattern. Considering that the first funds level hike on May perhaps 5, most housing markets about the region have viewed a sharper reduction in the amount of growth.

“Considering inflation is probable to continue to be stubbornly large for some time, and interest premiums are anticipated to rise substantially in response, it is probable the fee of decrease in housing values will keep on to assemble steam and come to be extra popular.”

Device marketplaces are keeping their price a minor far better than houses throughout the most significant capitals.

“The more powerful general performance throughout the device sector will come after dwelling values consistently outperformed models through the upswing,” Mr Lawless said.

“Since the onset of the pandemic in March 2020, money city unit values have risen 9.8% when compared to 24.7% for houses, ensuing in better affordability across the medium to high density sector.”

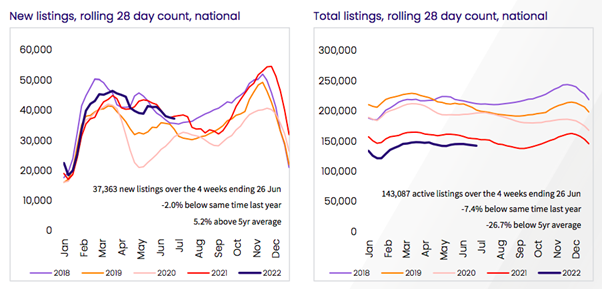

Listings on the increase

With selling price expansion starting to relieve, listings have been a person of the driving forces powering the slowdown.

When, national marketed stock degrees stay -7.4% lower than 2021, in Sydney and Melbourne, where housing conditions are the weakest, overall marketed source is now 7-8% higher than the ranges recorded a year back and well higher than the 5-12 months average.

Hobart has witnessed marketed stock ranges bounce 48.4% bigger relative to very last year and stock is 20.7% better in Canberra. While Adelaide, Brisbane and Perth, even now have listing levels decrease than the exact time previous 12 months.

Mr Lawless mentioned the increase in advertised source across some markets is generally due to a slowdown in the price of absorption.

“Estimated transactions in Sydney throughout the June quarter were being -36.7% lower than a calendar year ago when Melbourne is down -18.3%,” he reported.

“At the exact time, the stream of new listings included to the sector is falling as offering ailments becoming much more difficult and listings move into a seasonal lull.

“We aren’t looking at any symptoms of panicked selling as housing problems neat, in reality the craze is the opposite, with the move of new listings to the current market slowing.”

Source: CoreLogic

Rents nevertheless mounting

Rents are nonetheless increasing at .9% per month equating to an once-a-year maximize of 9.5%. This is the optimum yearly progress amount since December 2007 when file stages of overseas migration pushed rental demand larger.

“A reduction in regular house sizing via the pandemic will help to clarify these types of higher rental demand from customers during a time of shut worldwide borders,” Mr Lawless stated.

“Additionally, overall rental supply has likely been negatively impacted by the very long operating downturn in expense exercise concerning 2015 and 2021.”

Outlook skewed to the draw back

Australia’s housing current market outlook is starting to be ever more skewed to the draw back, with the trajectory of housing values seriously dependent on the route curiosity costs take.

Mr Lawless said higher inflation will carry on to set pressure on the RBA to hike costs, which will finally continue on to weigh on residence values.

“Although income exercise remained previously mentioned regular in the course of the June quarter, it is possible the variety of house gross sales will keep on to drift reduce as housing demand from customers cools and loan companies grow to be a lot more careful in their technique toward borrowers,” he claimed.

Mr Lawless said how significantly housing values drop as a result of the downturn stays remarkably unsure, on the other hand a peak to trough decline of extra than 10% is turning out to be far more mainstream throughout the numerous private sector forecasts.

Solid labour markets will be just one crucial issue in supporting home finance loan repayments and trying to keep distressed listings off the industry as effectively as borrower compensation buffers.

[ad_2]

Resource backlink