Property Prices Rise 0.6 Per Cent In Last Month

[ad_1]

House rates across the place noticed another boost in price previous month, even so, the price of boost continues to gradual down.

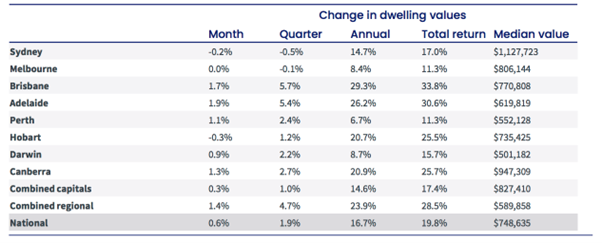

According to the most current information from CoreLogic, residence rates increased .6 per cent in April, led the moment once more by the scaled-down cash metropolis markets.

Adelaide was the best-performed cash city in April, seeing values boost by 1.9 per cent, followed by Brisbane at 1.7 per cent and Hobart with a 1.3 for each cent enhance.

House values in Sydney and Melbourne continue to gradual down after an amazing 18 months of growth. Sydney house selling prices fell -.2 for each cent, Melbourne remained flat while Hobart has also posted a slight tumble of -.3 for each cent.

In excess of the earlier 12 months, home rates are now 16.7 per cent better, with regional parts outperforming, up 23.9 per cent.

Source: CoreLogic

CoreLogic’s Investigate Director Tim Lawless stated mounting interest rates have begun to put stress on homebuyers which is translating to slow value growth.

“With RBA dollars charge established to increase, we are probably yo see a even more decline of momentum in housing conditions more than the remainder of the yr into 2023.” Mr Lawless said.

“Stretched housing affordability, better set phrase mortgage costs, a increase in listing quantities throughout some towns and reduce buyer sentiment have been weighing on housing problems about the previous yr. As the income charge rises, variable house loan prices will also trend bigger, reducing borrowing ability and impacting borrower serviceability assessments.”

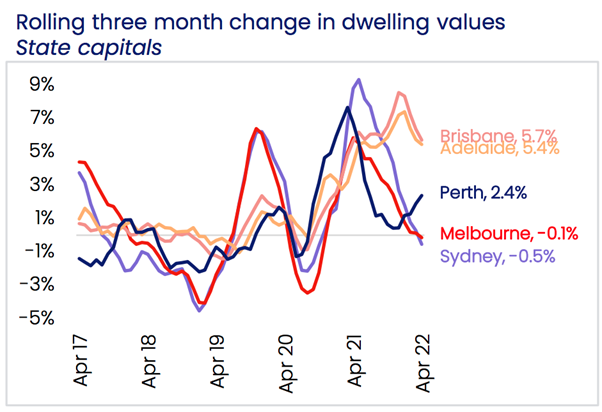

The Sydney and Melbourne markets have been the main two metropolitan areas to see slowing selling price growth and experienced moved into unfavorable territory on a quarterly foundation for the initially time since the 2020 lockdowns.

Mr Lawless mentioned that though the more compact cities are at this time nevertheless dealing with price appreciation, they also will probable see slowing development in charges as high desire charges just take their toll.

Resource: CoreLogic

Listings Stay Very low

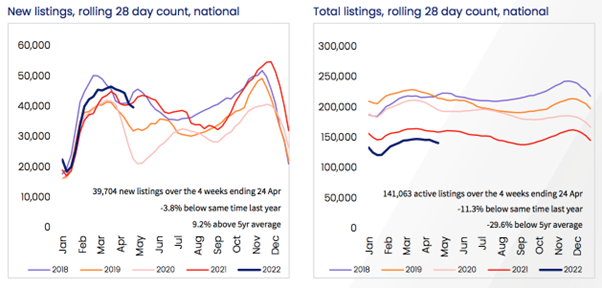

Even though selling price expansion has weakened, one of the continual themes over the past couple years that has aided drive charges increased has been the lack of accessible inventory on the market.

In accordance to CoreLogic, marketed stock, at a countrywide amount, is tracking just about 30 for every cent below the preceding five-calendar year common. Complete marketed stock is a lot more than 20 for each cent under ranges from a year back in Brisbane and Adelaide, and about 40 per cent decreased than the earlier five-12 months regular in both cities.

In weaker markets like Melbourne and Sydney, marketed offer stages have normalised. Sydney marketed stock concentrations are about in line with the previous 5-year common, when listings in Melbourne ended up 8.2 for each cent increased. Higher stock degrees throughout these markets can be spelled out by an earlier mentioned average circulation of new listings coming on the industry in combination with a fall in customer desire.

In Hobart, the place April’s -.3 per cent decline follows 22 consecutive months of advancement, inventory degrees begun to boost in the center of March.

The new listing count is now 46 for each cent bigger above the 4 months to April 24 in contrast to the similar period in 2021.

“With increased inventory levels and much less competitiveness, consumers are little by little transferring back again into the driver’s seat. That indicates more time to deliberate on their order decisions and negotiate on price tag,” Mr Lawless explained.

Supply: CoreLogic

Limited Rental Marketplaces

One more vital function of the past several yrs has been a absence of rental stock and mounting rental rates.

Just like in general residence markets, rental markets are also observing varying ailments in accordance to CoreLogic. Nationally, rents ended up up 2.7 for every cent above the three months to April, having the once-a-year change in rents to 9. for every cent. A year ago, the annual transform in national rents was 4.9 per cent.

Residence rents (+9.1 for every cent) are soaring more quickly than device rents (+8.7 per cent). However, this pattern is altering sharply as demand from customers for device rentals improves thanks to the bigger charge of leasing houses.

“On a rolling quarterly foundation, we are now seeing device rents soaring speedier than home rents, especially in Sydney and Melbourne exactly where rental situations across the unit sector have been previously much softer.”

“The shift in rental demand from customers toward units demonstrates both of those the rental affordability pressures, which are deflecting much more need in direction of the ‘cheaper’ unit sector, and the return of abroad migrants and website visitors… Rental demand from abroad arrivals tends to skew towards interior metropolis and significant density precincts.”

Market Outlook

House costs on a national degree continue to relieve with the peak place in position in March 2021 according to CoreLogic.

Price ranges have began to slow down in line with soaring preset-charge home loans and with reduce degrees of affordability.

With the income amount set to move through a speedy tightening cycle, CoreLogic expects the softening in the development level will turn out to be more pronounced over the coming months ahead of the national index starts off to craze lessen.

“Although we are anticipating the housing market place to move into a downturn by means of the next 50 % of the 12 months, it is vital to remember the context of the modern advancement phase,” Mr Lawless claimed.

“Considering that the onset of the pandemic, national housing values have improved by 26.2 for each cent, introducing roughly $155,380 to the median benefit of an Australian dwelling.”

The RBA famous a 2-percentage position increase in interest could decreased housing selling prices by 15 for each cent, which would consider home charges back to a similar degree to the place they had been in April 2021.

CoreLogic thinks the extent of any housing sector downturn relies upon on how substantial and how rapid the RBA raises interest premiums.

[ad_2]

Supply website link