The Hottest Real Estate Markets in 2022

[ad_1]

What Occurs When Incredibly hot Serious Estate Markets Great?

Even the greatest housing markets in the US, the hottest actual estate marketplaces, finally amazing off. It can happen steadily, or it can transpire (reasonably) all of a sudden, such as we observed in the housing bubble collapse just after 2008.

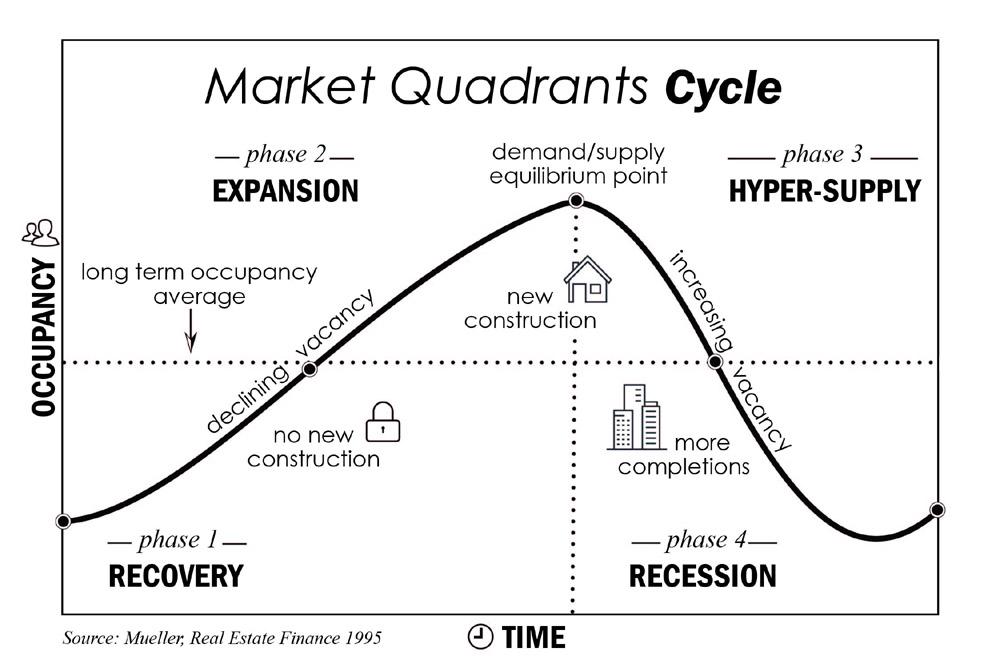

Housing marketplaces go by predictable cycles. A dearth of housing supply spurs extra new home building. Dwelling builders steadily construct up a head of steam, as the procedure from getting web pages through pulling permits to setting up the dwelling to marketing and advertising and offering them all normally takes time. At a particular stage, housing developers commence creating a lot more houses than the area need in fact requirements or desires, but by the time they find that, they nonetheless have months or even years to go in purchase to end current building projects.

At that position, source exceeds desire, and you see a housing sector correction. Developers prevent constructing, and inevitably provide gets pinched again, and the cycle repeats by itself.

Here’s a useful visual assist for superior evaluate:

Is the US in a Housing Bubble At this time?

Even though pieces of the US could currently be in a bubble, I doubt that most of the country’s markets are in a bubble, even the hottest actual estate marketplaces.

To get started with, offer — significantly of starter households — remains inadequate to deal with need, to put it mildly. Developing substance and labor expenses hover about document highs, putting added upward strain on home selling prices.

In the meantime, millennials have reached the “settle down in the suburbs and pop out some kids” section in their life. See over about the raise in very first-time homebuyers supercharging desire for housing.

So no, I never see a real estate bubble, at least for most markets in the US.

Ultimate Feelings

At the second, I see a good reshuffling of the deck having put in true estate markets. While the greatest, most pricey towns like New York and LA will hardly ever turn out to be irrelevant, even before the pandemic we noticed rents and need dipping. The increase in telecommuting should really exacerbate that development even after the pandemic is in the rearview mirror.

I see continued very hot housing marketplaces in locations with natural charm. Parts with attractive beaches or lakes, with good skiing and mountaineering, with background and society. Publish-industrial cities will need to reinvent themselves if they want to keep higher-money citizens soon after they uncover they can stay anywhere and telecommute to function.

Preserve an eye on all of the best real estate markets in 2022 showcased in the maps over. And notice that the best housing marketplaces in the US are mainly satellite towns, seeing astronomical development.♦

Exactly where are you at this time investing in genuine estate? What do you contemplate the greatest housing markets in the US?

A lot more Actual Estate Investing Reads:

[ad_2]

Resource connection